Effective Interest Rate Formula Math

Effective rate 1 nominal rate n n 1.

Effective interest rate formula math. The effective interest rate is calculated through a simple formula. 10 36 1 10 1 2. R 1 i n n 1. The formula and calculations are as follows.

The n is the number of times that. Effective annual interest rate 1 nominal rate number of compounding periods number of compounding periods. Pv fv 1 r n. N number of periods.

The formula for compound interest is p 1 r n nt where p is the initial principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. Effective interest rate can be computed using the following formula. Get your calculator and check to see if you re right. The basic formula for compound interest is.

Familiarize yourself with the formula for converting the stated interest rate to the effective interest rate. When the amount of interest the principal and the time period are known you can use the derived formula from the simple interest formula to determine the rate as follows. Follow these steps to calculate effective interest rates. Finds the future value where.

Fv future value pv present value r interest rate as a decimal value and. Fv pv 1 r n. The good news is that we already have a formula in place to do just that. Where n is the number of compounding periods per year.

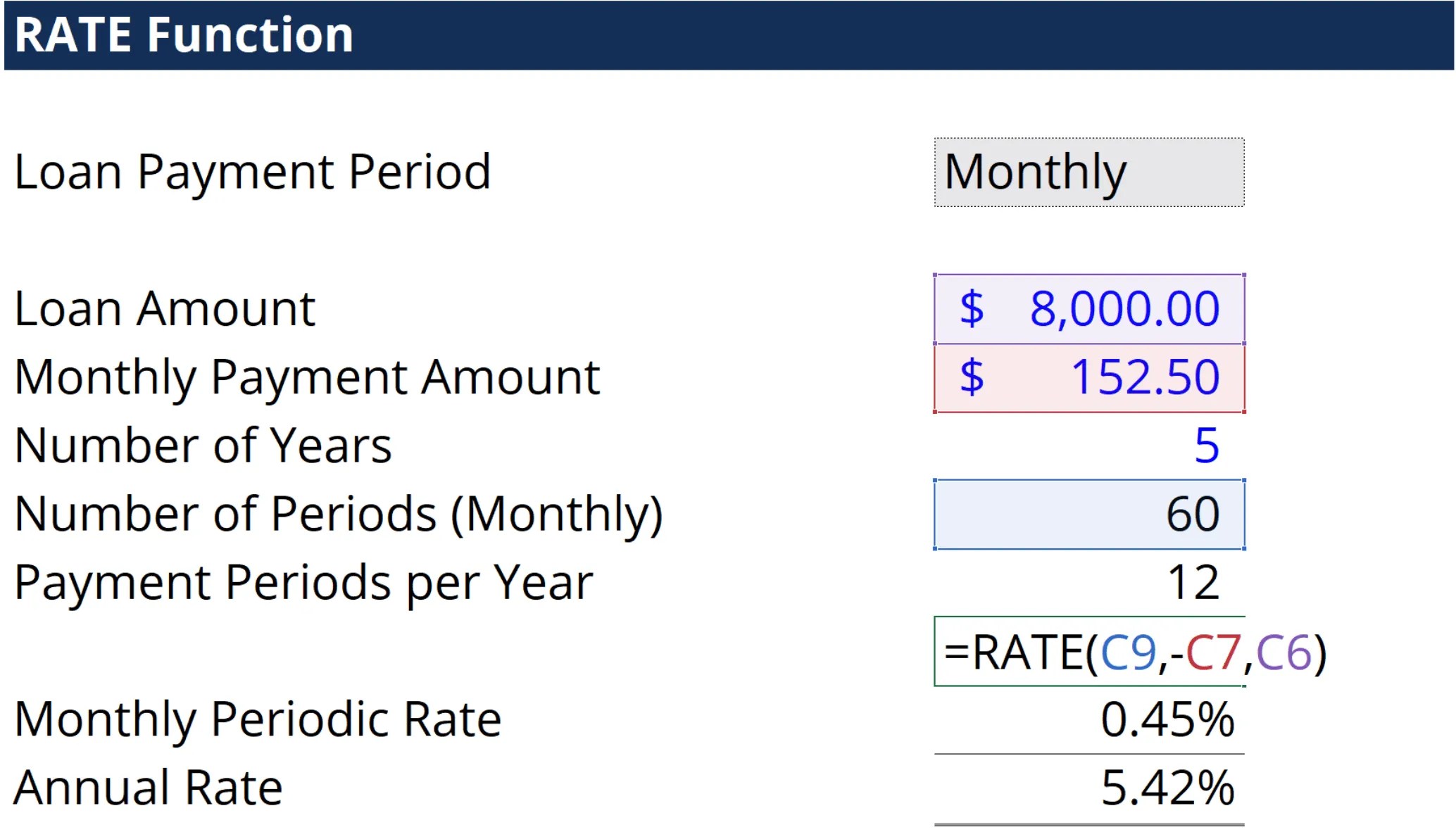

I prt becomes r i pt remember to use 14 12 for time and move the 12 to the numerator in the formula above. For investment a this would be. And by rearranging that formula see compound interest formula derivation we can find any value when we know the other three. Apply formula 9 1 to calculate the periodic interest rate iold for the original interest rate.

In this formula the i stands for the interest rate that is given to you by the company. Identify the known variables including the original nominal interest rate iy and original compounding. In this formula r represents the effective interest rate i represents the stated interest rate and n represents the number of compounding periods per year. 10 47 1 10 12 12 1 and for investment b it would be.