Irr Discount Rate Math

The internal rate of return is a discount rate that makes the net present.

Irr discount rate math. Or this quick summary. I r r r 1 n p v 1 r 2 r 1 n p v 1 n p v 2 where. Npv 0 irr of the investment is higher than the discount rate used. The internal rate of return irr is the discount rate that makes the net present value npv of a project zero.

Calculating the net present value. The internal rate of return irr is about 7 so the key to the whole thing is. Solving the irr equation by hand is a time consuming and inexact process. In the example below an initial investment of 50 has a 22 irr.

It is commonly used to compare and select the best project wherein a project with an irr over an above the minimum acceptable return hurdle rate is selected. Note that the present value of a given income stream decreases as the discount rate increases. Irr is the discount rate that makes the net present value npv of a project negative. Which of the following is true about the internal rate of return irr.

Irr is the discount rate that makes the net present value npv of a project positive. Npv 0 irr of the investment is lower than the discount rate used. The discount rate is a required return by active investors in the local real estate marketplace for investments in properties of similar type and risk. Irr is the discount rate that makes the net present value npv of a project 0.

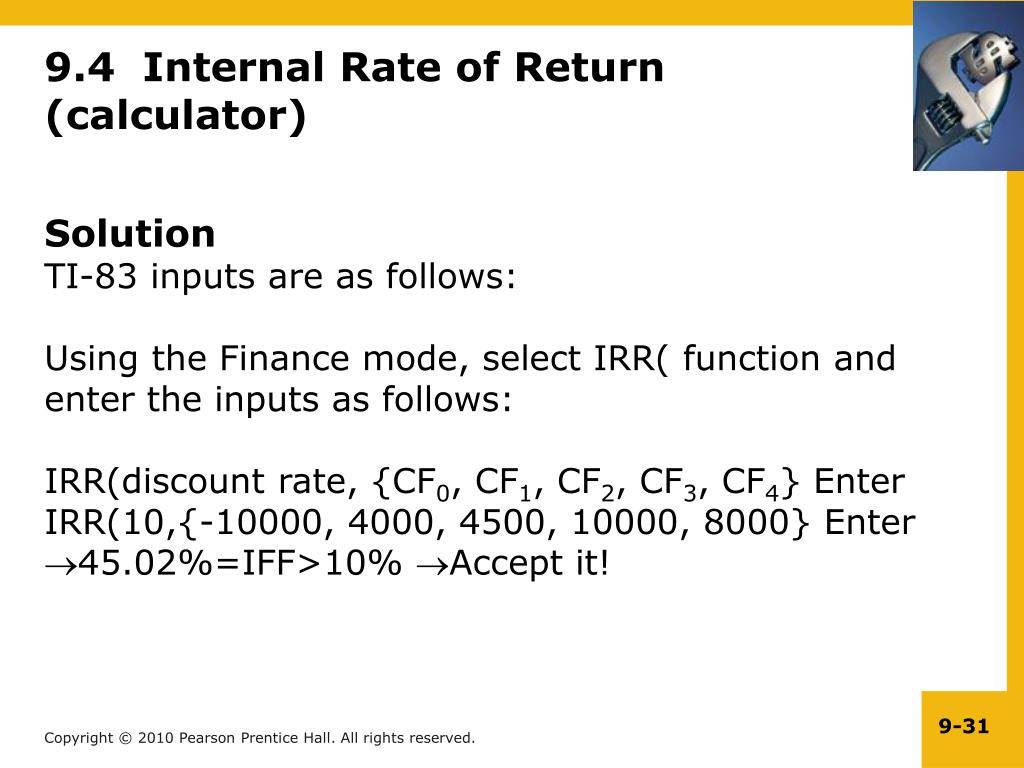

Read net present value. Definition of internal rate of return irr internal rate of return irr is the discount rate that sets the net present value of all future cash flow from a project to zero. In other words it is the expected compound annual rate of return that will be earned on a project or investment. An investment has money going out invested or spent and money coming in profits dividends etc.

Irr will return the internal rate of return internal rate of return irr the internal rate of return irr is the discount rate that makes the net present value npv of a project zero. For a given cash flow that is the initial investment value and a series of net income values. In order to better demonstrate the cases in which negative npv does not signal a loss generating investment consider the following example. R 1 r 2 randomly selected discount rates n p v 1 higher net present value n p v 2 lower net present value begin.

The internal rate of return is a metric used in financial analysis to estimate the profitability of potential investments. Npv 0 irr of the investment is equal to the discount rate used.

/stock-market-836258860-d77c2ae20cf849a491583ed4008547e4.jpg)